2024 Author: Leah Sherlock | [email protected]. Last modified: 2023-12-17 05:25

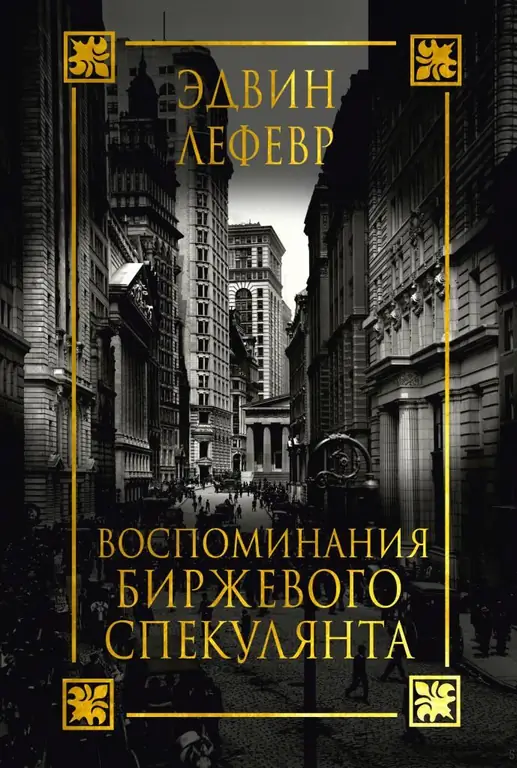

It seems that so much has been written about how the mechanism of financial transactions taking place on Wall Street is “ticking”, the economy is developing so quickly and unpredictably, that the reason for the almost century-old popularity of E. Lefebvre’s book “Memoirs of a stock speculator” is completely incomprehensible.

A little about the author

Edwin Lefèvre (George Edwin Henry Lefèvre) was born in 1870 in Colón, Colombia (now Panama). He is a graduate of Lehigh University, a mining engineer, but the young man was much more attracted to journalism.

It's no surprise that Edwin Lefevre's biography is taking a sharp turn. At the age of fifteen, having started working for the New York Sun collecting data on daily quotes, he becomes a staff interviewer for the newspaper.

Communicating with various economists, traders, brokers and investors, Edwin Lefebvre gets acquainted with the laws and rules of tradingexchanges, the formation of transactions and financial instruments, begins to understand them like a professional.

But he does not become either a forex trader or an investor, but chooses the path of a writer. In 1901, Edwin Lefevre published the first collection of Wall Street stories. These are short stories about the life and work of business on the largest stock exchange in New York, which were previously published in newspapers and magazines. Edwin himself never showed excitement, did not "dabble" with stocks, but received information mainly through communication and interviewing real business tycoons. His natural ingenuity, ability to find non-standard solutions, journalistic flair and curiosity and talent to "talk" the interlocutor were his main assistants.

The events and upheavals of 1929 helped the writer to better understand that “it is impossible to always win”, leaders also make mistakes, only a little later than gambling and stupid businessmen.

Features of E. Lefebvre's books

Edwin Lefebvre's books, more like fiction in style, teach how to trade the stock markets in an easy to read and understandable way.

But the real fame that allowed him to become a classic of American literature, brought the work "Memoirs of a Stock Operator" (Reminiscences of a Stock Operator). Sometimes its name is translated as "Notes of a Stock Speculator". The book was published in 1923.

In total, E. Lefebvre wrote eight works, but the most read is "Memoirs".

The author died in 1943 at the height of the Secondworld war. His sons became successful businessmen and politicians.

Summary of the book "Memories"

She talks about the life and career of Larry, inspired by real-life businessman Jesse Lauriston Livermore. He lived to 63 years and was one of the most successful stock speculators of his time. The book is his fictionalized biography.

At the age of 15, Larry tried to work as a clerk in a small bookmaker's office, tried to "do his own business", that is, to speculate, successfully earning money. But the young man was kicked out with a bang. Larry moves to New York, where he gets involved in a serious stock game. He wins and loses again, but with each attempt he gains serious experience and skills, finds his own style of doing business. With each failure, Larry plays better and better, learning to predict the periods of ups and downs of stocks, the moments of their fluctuations. So he becomes very rich and famous, large and serious companies need him. Each step of the protagonist in business is considered and analyzed by the author, who himself has mastered the laws and rules of working on the stock exchange and shares with readers the lessons that this work has given him.

Memories does not provide ready-made answers to specific or general questions. This is not a textbook. The book does not teach how and how much to buy and sell, but explains the principles and rules of the market, examines the mistakes made by beginners when speculating. It does not provide figures, few statistics, no charts and other things. Artistically instructivethe history will be useful both for a player on the stock exchange and for a person who is far from transactions. The talent of a psychologist and the extraordinary mind of the author made the main character open his soul, look for the reasons for each of his defeats, find the reasons, draw the right conclusions and correct mistakes. The book of "Memories" is able to give a motivational boost to anyone who has a desire to get into trading. It shows all the moves and exits that exist in the game on exchange rates, reveals the psychology of investing. "Memories" helped more than one generation of traders to become successful, demonstrating how simple common sense, the ability to think outside the box and work on your own mistakes help not only in playing stocks, but also in conducting any trade.

Book reviews

Almost all reviews of Edwin Lefevre's book are more than positive. It is called precious, interesting, smart, optimistic, necessary, etc. The book has been translated into a huge number of languages and is an original textbook for those who want to devote themselves to business. It is noted that the author teaches you to think with your own head, make decisions on your own, that the book is useful for both beginners and experienced traders, and not only them.

Some interesting points from the book

- It is necessary to know not only the direction of movement of the rates, but also the moments of the beginning and end of the game.

- Great incomes will be only with significant changes in exchange rates.

- There is and never is anything new on the stock exchange.

- The desire to constantly buy and sell is destructive, a good trader must be able to wait and do nothing.

- A trader never argues with reality.

- Manipulation must be based on common sense trading.

- Speculation takes a very long time.

- Losses must be limited in every possible way.

- The speculator must believe in himself and his judgment.

Afterword and conclusions about the book by E. Lefevre

Despite the existence of a number of books about the trading path of the protagonist, none of them can compare in popularity with the Memoirs of a Stock Operator.

Edwin Lefevre's book is liked by readers for its simplicity and honesty, which also distinguished its prototype - Jesse Livermore. He always repaid debts up to a million dollars. A mandatory measure of success in the game on the stock exchange, according to Livermore, should be faith in oneself. Reading like a detective novel, the book is an excellent tool for raising morale, as well as understanding the mechanisms, rules and psychology of the "pit" of Wall Street. The ending of the book hints that the reader must make the right choice for himself. There are a lot of things in the book that are worth learning. Some readers will level up as merchants, while others will simply enjoy a well-written, smart book.

Recommended:

Graffiti on the wall of the house and in the apartment. Street art and contemporary interior design

Graffiti adds a special charm to any living space, fills it with street energy and inexhaustible creative potential. Recently, an increasing number of people are trying to add colors and positivity to their homes in this way. Most of them are young guys who live for today and are not afraid to experiment

"Sesame Street": characters by name. What are the names of the characters on Sesame Street?

Sesame Street is a long-lived children's educational and entertainment program. The characters of this program appeared in the late sixties of the last century. During this time, more than one generation of kids has changed, who grew up with the funny characters of the show

Vaclav Nijinsky: biography, date and place of birth, ballet, creativity, personal life, interesting facts and stories, date and cause of death

The biography of Vaslav Nijinsky should be well known to all fans of art, especially Russian ballet. This is one of the most famous and talented Russian dancers of the early 20th century, who became a true innovator of dance. Nijinsky was the main prima ballerina of Diaghilev's Russian Ballet, as a choreographer he staged "Afternoon of a Faun", "Til Ulenspiegel", "The Rite of Spring", "Games". He said goodbye to Russia in 1913, since then he lived in exile

Street art. Street art in Russia and the world

Street artists make the black and white world colorful, the faceless walls of housing estates are turned into objects of art. But the main value of street art is not in its aesthetic side, but in the fact that thanks to it people think about the pressing problems of our time, about eternal values and their role in this world

"The Wolf of Wall Street": movie reviews, plot, actors, main character, release date

The Wolf of Wall Street is a 2013 film that tells the story of financial criminal Jordan Belfort. It still remains relevant in the audience circles. This is not surprising, because the picture has become one of the best collaborations between the director-actor duo Martin Scorsese and Leonardo DiCaprio. The plot, basic information, interesting facts and audience reviews about the film "The Wolf of Wall Street" - all this you will find in this article